Online Trading App That Simplifies Investing

Managing investments today has become more accessible thanks to digital tools. An online trading app offers a platform where individuals can buy and sell various financial instruments directly from their devices. It also allows easy integration with a Demat account, which is necessary for holding securities in electronic form. For both beginners and experienced investors, the right app can simplify the process of trading and portfolio management.

This explains how an online trading app works, its key features, and how linking it to your Demat account can help you make better investment decisions without unnecessary complexity.

Understanding the Basics of Online Trading

Online trading refers to buying and selling financial assets such as shares, bonds, commodities, or derivatives using a digital platform. An online trading app acts as the interface between the investor and the market. Instead of visiting a broker’s office, investors can complete transactions through their phone or computer, making the process faster and more convenient.

A Demat account works alongside this setup by holding securities in an electronic format, removing the need for physical certificates. This combination ensures that transactions are both quick and secure.

Importance of a Demat Account in Online Trading

A Demat account is essential because it enables the storage and transfer of securities without paperwork. When you purchase shares through an online trading app, they are credited to your Demat account. Similarly, when you sell them, the securities are debited.

The link between a trading account and a Demat account is what allows a seamless investment experience. Without a Demat account, you cannot settle trades in most market segments.

Features of an Effective Online Trading App

When choosing an online trading app, investors should look for features that make the process simple and efficient. Key elements include:

- User-friendly navigation for quick trade execution.

- Real-time market data for informed decision-making.

- Portfolio tracking to monitor investments across different asset classes.

- Secure transactions with proper encryption and verification measures.

- Integration with Demat accounts for smooth settlement of trades.

These features ensure that both novice and seasoned investors can manage their portfolios effectively.

Advantages of Using an Online Trading App

Trading through a mobile or web-based application offers several advantages:

1. Convenience

Investors can trade from anywhere without visiting a broker’s office. This flexibility makes it easier to respond to market changes instantly.

2. Speed

Orders can be placed and executed within seconds, reducing the risk of missing opportunities.

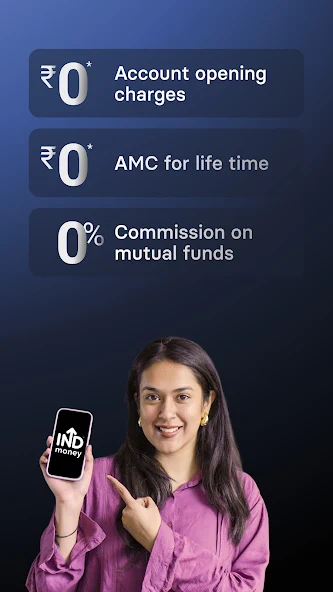

3. Lower Costs

Many platforms offer competitive transaction fees compared to traditional brokerage services.

4. Direct Market Access

An online trading app connects directly to market exchanges, enabling faster data updates and trade confirmations.

How to Start with an Online Trading App

Starting with an online trading app involves a few steps:

Step 1: Open a Demat Account

Before you can trade, you need a Demat account to store your holdings electronically. Most brokers facilitate the account opening process digitally.

Step 2: Download and Register

Install the app on your smartphone or access it through a web browser. Complete the registration process by providing identification and banking details.

Step 3: Link Trading and Demat Accounts

Ensure both accounts are connected so trades can be settled automatically.

Step 4: Fund Your Account

Transfer funds to your trading account to start buying and selling assets.

Step 5: Begin Trading

Use the app’s dashboard to place orders, track prices, and review your portfolio.

Tips for Effective Use of an Online Trading App

- Learn the Interface – Spend time understanding the platform’s features before placing real trades.

- Use Alerts – Set price alerts to track potential entry or exit points.

- Review Transaction Costs – Keep track of charges that may affect returns.

- Secure Your Account – Enable two-factor authentication to prevent unauthorized access.

- Stay Updated – Follow market trends and company announcements for informed trading decisions.

Common Mistakes to Avoid

Even with a reliable online trading app, mistakes can affect results:

- Overtrading: Placing too many trades can lead to higher costs and reduced profits.

- Ignoring Account Security: Failing to update passwords or enable security settings can risk account safety.

- Neglecting the Demat Account: Ensure your Demat account is active and linked; otherwise, trades may not settle.

- Not Reviewing Market Conditions: Trading without checking market news can lead to poor decisions.

Future of Online Trading Apps

The technology behind online trading is evolving. Artificial intelligence, automated order execution, and improved analytics will further simplify the process for users. Additionally, tighter integration between trading and Demat accounts will enhance efficiency, making it easier for investors to manage diverse portfolios in one place.

Conclusion

An online trading app has transformed the way individuals invest. By connecting it to a Demat account, investors can enjoy a streamlined, paperless, and secure trading experience. The right app not only facilitates transactions but also offers tools to track, analyze, and improve investment strategies.

For anyone looking to participate in the financial markets, starting with a reliable online trading app and a functional Demat account is a practical step toward effective investing. With the right approach, these tools can help simplify the process while providing the flexibility to trade from anywhere.