Upgrading Payments For Enhanced Financial Convenience

In our culture of ever-linked connectivity, managing money and making payments has become mostly digital. Technology has transformed our handling of our financial obligations, from bill payment to money transfer. This article explores the developments of the digital payments and financial management market, emphasizing important characteristics of modern payment apps meant to streamline our regular financial chores.

Simplifying Credit Card Payments:

The most significant advancement in digital finance is the ease of credit card management. By consolidating credit card management in one place, users can better track their spending and ensure timely payments, potentially improving their credit scores over time. Key features such as:

- Centralized platform for multiple cards

- Quick and secure hdfc card payment options

- Automated bill reminders to avoid late fees

Streamlining Bill Payments:

Digital payment apps have upgraded the way we handle recurring expenses. These services often come with the added benefit of payment tracking and history, allowing users to budget more effectively and maintain a clear overview of their monthly expenses. These benefits include:

- Utility bill payments

- Subscription services

- Online mobile bill payment features

Effortless Money Transfers:

The ability to transfer money securely and almost instantly is a cornerstone of modern financial apps. This functionality not only saves time but also reduces the need for physical cash transactions, making financial management more convenient and secure. These advantages include:

- Peer-to-peer transfers

- Bank-to-bank transactions

- Options for money transfer online to various accounts

Automated Payment Systems:

To further simplify recurring payments, many platforms now offer automated payment options. These features ensure that users never miss a payment while maintaining control over their financial outflows. These options include:

- UPI auto pay for regular bills and subscriptions

- Scheduled transfers for rent or loan payments

- Customizable payment limits for added security

Enhanced Security Measures:

With the increase in digital transactions, security has become paramount. These measures work together to protect users’ financial information and provide peace of mind when conducting online transactions. Key security features include:

- Multi-factor authentication

- Real-time transaction alerts

- Encrypted data transmission

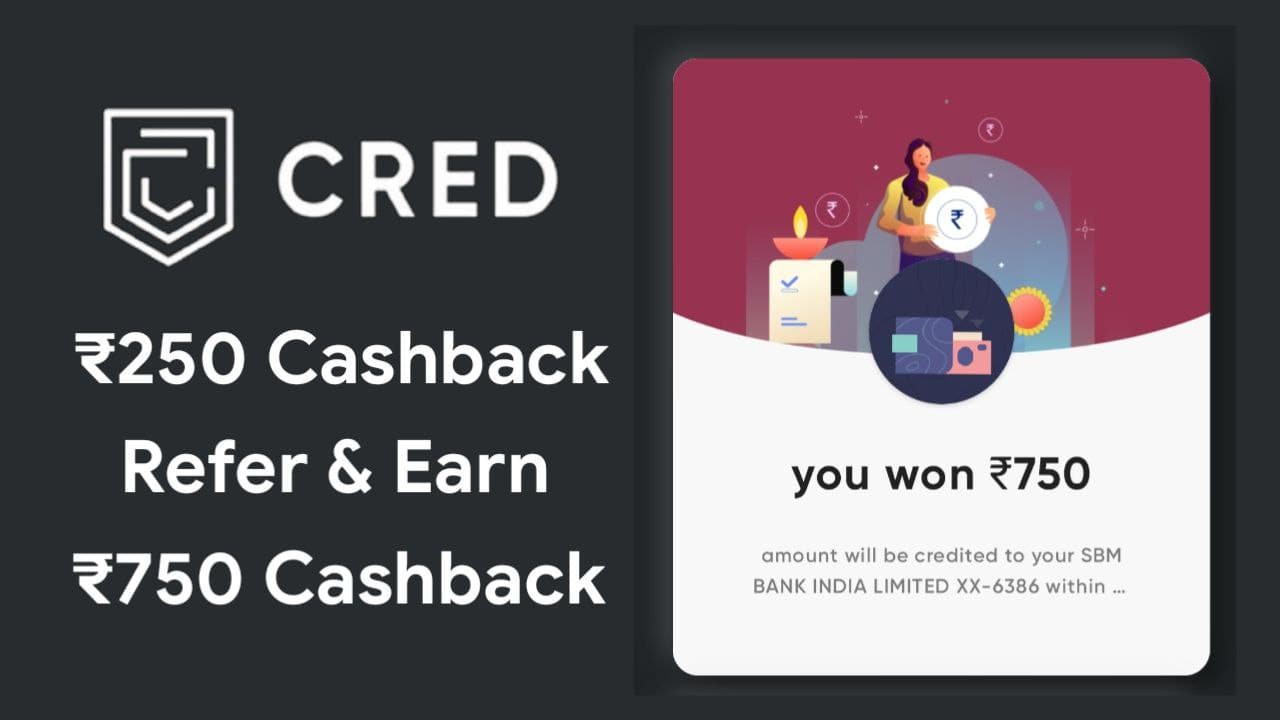

Rewards and Incentives:

Many digital payment platforms now offer rewards programs to encourage usage. These incentives not only save money but also promote responsible financial behavior among users. These rewards include:

- Cashback on bill payments

- Points for credit card transactions

- Exclusive discounts with partner merchants

Future of Digital Payments:

As technology develops, we should anticipate increasingly creative elements in the digital payment scene. These upcoming developments will enable consumers to exercise greater control over their financial lives and help to simplify the payment procedure even further. Future upgrades may include:

- Integration with artificial intelligence for personalized financial advice

- Blockchain technology for enhanced security and transparency

- Biometric authentication for faster and more secure transactions

Conclusion:

The market for digital payments is changing and presents ever-more advanced financial management solutions. Consumers who use these technologies may have more financial control, save time on daily chores, and have a better general financial situation. Adopting these solutions will help one have a more orderly and effective financial life as we enter the digital era.