Discover The Power Of Banking Apps For Loans And Payments

Traditional banking is becoming less important in the modern age as digital solutions become more effective substitutes. The way that people and organizations handle their finances is changing significantly as a result of the introduction of various banking apps and cash management softwares. Apps have completely changed how financial services will be provided in the future, from managing daily transactions to obtaining enterprise loans.

Development of banking app

People can now receive banking services directly from their cellphones thanks to the growth of digital platforms. In addition to being convenient, modern banking apps come with a lot of features. Users are depending more and more on these applications to make banking easier, whether it’s a cash bank app for handling funds while on the road or a bank cash app for rapidly checking balances.

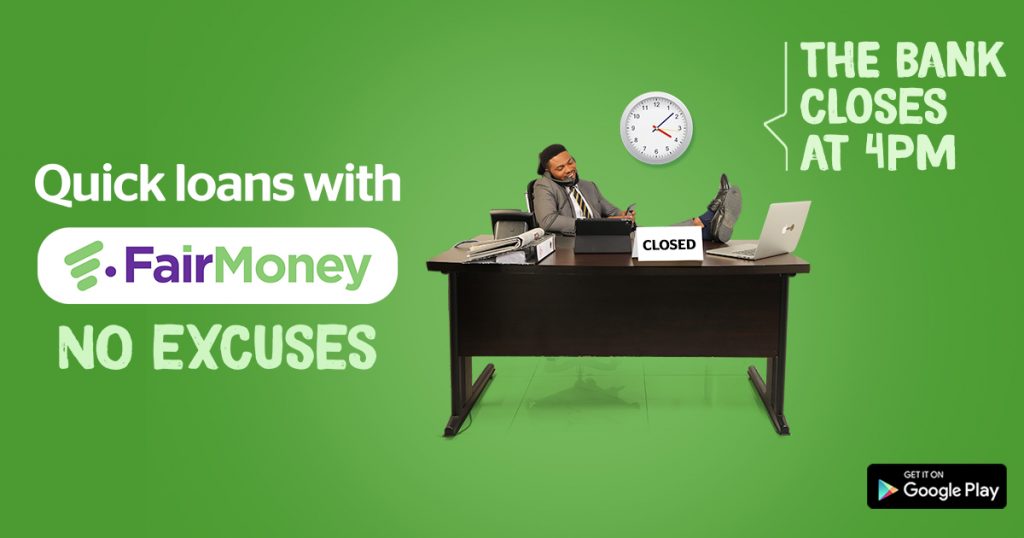

For entrepreneurs, this digital transformation is important. These days, getting a company loan doesn’t involve a ton of paperwork or numerous trips to the bank. Business owners may now request for loans straight from their phones and receive approval in a few hours if they use the appropriate bank cash app. It’s a smooth method of guaranteeing cash flow for small businesses or startups looking to scale.

Payday loan and microfinance bank

For a long time, payday loans have been a convenient way for people who need urgent money. Payday loan applications are now quicker and easier to complete because of banking apps. Microfinance bank services are easily accessible through applications like Opay, which also serve businesses and make money instantly available.

Particularly in underdeveloped nations, microfinance institutions are essential for helping small enterprises. These organizations lend money to people who might not otherwise have access to traditional banking. Digital platforms are making microfinance bank loans even more accessible, especially via bank cash apps that make the application process for loans easier and provide borrowers with monetary resources.

Opay’s role in digital finance

Opay is a unique app in the internet-based banking market that can be used for personal as well as professional financial purposes. Users may utilize a variety of services through Opay, including business loan, transfers, and bill payment. As a banking app, it streamlines routine financial chores and provides a framework for business expansion.

Opay also gives people access to short-term loans, such as payday loans, for those who need money quickly. These loans are a lifeline for people in dire situations. The blend of Opay’s pricing, usability, and efficiency distinguishes it from competing banking apps.

Conclusion:

As digital banking solutions become more popular, more people than ever before are becoming financially inclusive. Businesses and individuals alike are being empowered by money banking app, which give them access to necessary financial services for only a portion of the ordinary price.

Digital banking is changing the way we think about money, whether you’re a small business owner looking for a business loan or an individual in need of a payday loan. The future of finance is digital, easy, and inclusive thanks to apps like Opay and the expanding power of microfinance institutions.