Mutual Fund Investment Strategies For Steady Growth

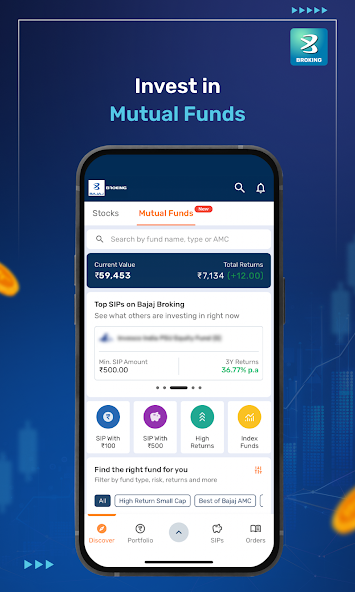

Building financial stability requires a thoughtful approach, and one of the most practical ways to work toward long-term goals is through a well-structured Mutual Fund Investment plan. Many individuals rely on a Mutual Fund Portfolio to organize their savings, lower risk, and grow their wealth gradually. With proper planning and a disciplined approach, a Mutual Fund Investment strategy can help create steady and consistent progress over time.

A Mutual Fund Portfolio offers the convenience of diversification and professional management, making it suitable for different financial goals. Whether you want to grow your savings or create long-term stability, understanding how these strategies work can help you make informed decisions. Below is a complete design to help you structure, maintain, and enhance your approach to Mutual Fund Investment.

Understanding the Purpose of Mutual Fund Investment

A Mutual Fund Investment is designed to give individuals access to a structured investment avenue with reduced complexity. Instead of selecting each security individually, investors can use a Mutual Fund Portfolio to spread their money across multiple assets. This reduces exposure to sudden market shifts and helps maintain stability.

A strong Mutual Fund Portfolio is built around clear objectives. Before starting, it is important to decide whether your aim is long-term capital growth, regular income, or a combination of both. This clarity shapes every choice that follows.

Setting Clear Financial Goals

Planning is a core part of creating a stable Mutual Fund Investment strategy. Identifying the purpose of your investment helps determine the right mix of funds for your Mutual Fund Portfolio.

Types of Investment Goals

- Short-term goals: These may include building an emergency reserve or saving for an upcoming requirement.

- Medium-term goals: Examples include planning for education, a vehicle purchase, or a home-related need.

- Long-term goals: These often involve retirement preparation or building wealth over a long horizon.

Once your timeline is clear, selecting the appropriate fund types for your Mutual Fund Portfolio becomes much easier.

Choosing the Right Mix for Your Mutual Fund Portfolio

Diversification plays an important role in steady growth. A balanced Mutual Fund Portfolio spreads your investment across different categories, which helps reduce the impact of market fluctuations.

Diversification Approaches

- Asset allocation: Balancing between equity, debt, and hybrid options helps align risk levels with your financial goals.

- Risk profile matching: Conservative investors may prefer more stable options, while those with a higher risk appetite may select growth-oriented choices.

- Investment horizon matching: Longer time horizons can accommodate options with higher market exposure, while shorter horizons may require safer selections.

By blending these categories, a Mutual Fund Investment can support steady growth with controlled risk.

Systematic Investment Approach

A disciplined strategy is essential for maintaining consistency. One common method involves investing a fixed amount regularly. This approach helps reduce the effect of market volatility by spreading purchases over time.

Benefits of Consistent Contributions

- Creates structured habit-based investing

- Helps take advantage of various market phases

- Reduces the stress of timing the market

- Builds wealth smoothly over the long term

Such contributions make it easier for your Mutual Fund Portfolio to grow gradually, without relying on market predictions.

Reviewing and Adjusting Your Mutual Fund Portfolio

Portfolio review is a key part of long-term success. A Mutual Fund Investment should align with your financial plans, and those plans may evolve over time.

Why Portfolio Review Matters

- Personal goals may change

- Risk tolerance can shift over time

- Market cycles may affect asset balance

- New opportunities may arise

Adjusting your Mutual Fund Portfolio periodically ensures that your investments stay relevant and balanced.

Managing Risk in Mutual Fund Investment

Risk is a natural part of investing, but proper planning can help manage it effectively. Being aware of different types of risks can help you prepare and adapt.

Common Risks to Consider

- Market-related changes that affect fund values

- Interest rate movements that impact debt instruments

- Economic factors that can shift market behavior

Understanding these elements allows you to shape your Mutual Fund Portfolio in a way that suits your comfort level and expectations.

Long-Term Perspective for Steady Growth

Mutual Fund Investment works best when viewed from a long-term angle. Short-term fluctuations are normal, but consistent investing helps smooth out these movements.

Advantages of Long-Term Focus

- Encourages disciplined decision-making

- Allows compounding to enhance growth

- Reduces the impact of temporary volatility

- Helps achieve stable and predictable outcomes

Patience is a key factor in building a strong Mutual Fund Portfolio that supports future financial needs.

Conclusion

A steady and structured approach to Mutual Fund Investment can help build long-term financial stability. Creating a well-planned Mutual Fund Portfolio, maintaining regular contributions, and reviewing your investments periodically are essential parts of this journey. When you prioritize clarity, discipline, and long-term focus, your Mutual Fund Investment can become a powerful tool for achieving lasting progress.

A carefully designed Mutual Fund Portfolio ensures that your investments grow steadily while maintaining balance and minimizing unnecessary risks. By following these strategies, you can work toward consistent financial growth and create a foundation that supports your goals for years to come.