Understanding The Basics Of Mutual Funds Investment

Mutual funds are frequently the preferred choice for Indian investors who want to make their money work for them. The appeal of mutual funds is their ease of use and versatility, irrespective of your level of experience. Let’s dive into why mutual funds in India have become a preferred choice for so many and how you can make the most of this investment option.

What do you mean by mutual funds?

Let’s make mutual funds simple before we go into the specifics. Consider them as a group investment in which funds from several investors are combined and overseen by experts. These experts invest the money in stocks, bonds, and other securities, among other things. The objective? To produce profits for all parties.

Mutual funds offer a simple way for a novice investor to get started in the financial industry. There are several solutions catered to various risk tolerances and financial objectives, and you don’t have to be a specialist in order to get started.

Benefits of investing in mutual funds:

Mutual fund investment is perfect for investors with a variety of goals. There is probably a mutual fund that meets your objectives, whether you want to accumulate money for the foreseeable future or just want a steady income. One of the main factors contributing to their appeal is their capacity to match how you invest with your financial objectives.

Diversification is among mutual funds’ most important benefits. Investing in a mutual fund lowers overall risk because your money is distributed among several assets. Because of this diversification, your portfolio will remain stable even if one of your investments underperforms because the losses may be offset by other assets.

Mutual fund managers are also seasoned experts who keep a close eye on market developments and make wise choices. This degree of experience benefits investors who are too busy or don’t know enough to handle their assets on their own.

The low barrier to admission is another significant advantage. It doesn’t take a lot of money to begin investing. With a Systematic Investment Plan (SIP), several funds allow you to start with as little as ₹500. This encourages participation from even first-time investors by making mutual funds affordable for investors of all income levels.

Importance of a mutual fund tracker:

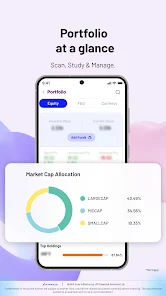

Monitoring your mutual funds after you’ve made an investment is crucial to making sure your portfolio reflects your financial goals. An easy-to-use tool for tracking your assets, a mutual fund tracker gives you information on portfolio structure, efficiency, and profits.

Features like goal tracking, previous data comparisons, and performance notifications are frequently included in trackers. With the help of these tools, you can make proper choices that will keep your investments on course.

Do safe mutual funds make sense?

Safe mutual funds offer a mix between stability and rewards for investors who are risk averse. Although no mutual fund option is risk-free, alternatives such as debt and liquid investments are thought to be less hazardous than equity funds.

Debt funds mostly invest in instruments with fixed income, which provide lower risk and consistent returns, like corporate debentures and bonds from governments. In a comparable way, liquid funds concentrate on investments with a short duration and offer a secure location to keep your money while preserving liquidity.

Conclusion:

It doesn’t have to be scary to invest in mutual funds in India. Mutual funds provide a number of solutions to meet your goals, whether your goal is immediate security or the accumulation of wealth over time. Begin modestly, monitor your investments, and look into funds that fit your risk tolerance.

With the correct strategy, investing in mutual funds can play an important role in your financial journey, assisting you in reaching your objectives and successfully controlling risk. Additionally, remember to use a trustworthy mutual fund tracker to keep tabs on your progress. After all, making educated selections is the key to investing sensibly.

Are you prepared to start? Discover the mutual fund that best suits your budgetary objectives by exploring the market. Who knows? It might be the most intelligent.